Peanut Acreage

Posted by romeethredge on July 5, 2013

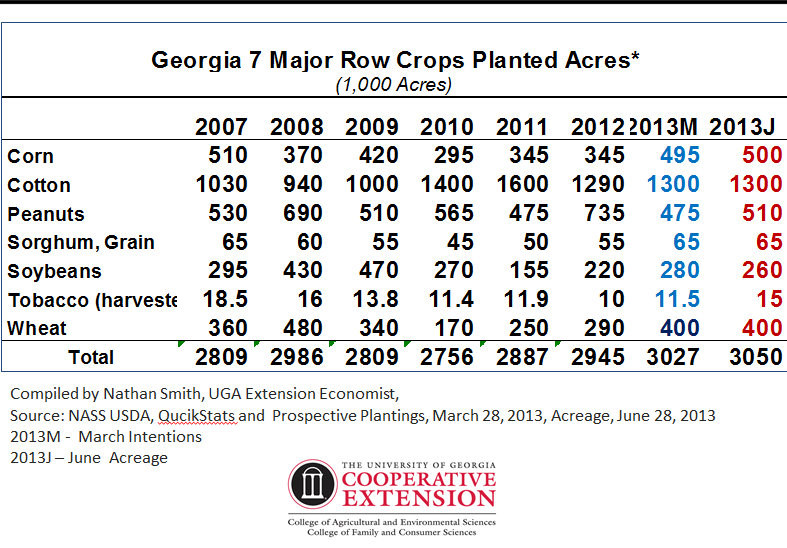

The June 28th Acreage report pegged Georgia peanut acres at 510,000 acres, according to Nathan Smith, UGA Extension Ag Economist. This is 35,000 more than March intentions and 225,000 acres less than 2012, a 31% decrease. Planting started out behind pace but made up a lot of ground the second half of May. Georgia acreage, if it stands at the current estimate, is about what was expected given the relative cost and returns to corn, cotton and soybeans. The real surprise is corn coming in at nearly the same as peanuts at 500,000 acres. Even with corn seed being turned back in to dealers, apparently a lot of corn was planted before it was time to switch to cotton and peanut planting. One wonders if some growers over-ordered corn seed in anticipation of preferred varieties being short. Cotton stayed at 1.3 million according to the surveys conducted by NASS which would have to be the case if corn increased 45% over last year.

Regionally, the Southeast is down a third from 2012 with Alabama down 41% to 130,000 acres, Florida down 29% to 150,000 acres, and Mississippi down 54% to 24,000 acres. The Southwest is down 43% led by Texas at 80,000 acres, down 47% from 2012. Oklahoma is down 25% to 18,000 acres and New Mexico dropped to 6,000 acres, 40% lower than last year. I am not certain if or how Arkansas acreage is counted in the overall estimate but my guess is they have 12,000 to 15,000 acres. The Virginia-Carolina region shifted away from peanuts by 24%, not as big a drop as other regions but a return to the 2011 level. The three regions together total 1.097 million acres. Using USDA projected yield of 3,800 pounds/acre and harvested acreage of 1.963 million, total production would be slightly more than 2 million tons. That might be an optimistic yield but last year certainly begs the question have yields reached new a level of expectations. Will 2013 be the year that shows what the yield potential is of the newer varieties given a more normal weather pattern?

Given June demand projections, it appears carryover stocks will end at 1.2 million tons for the 2012 marketing year. Food demand looks to be healthy at 3.5% increase but with large supply there is opportunity to grow more. The 2013 marketing year is projected to increase just under 3%. Exports will be the key as to whether Chinese purchases will resurface. If they do, the low acreage will bring us back to a tight situation very quickly. However, the current estimates show 325,000 tons compared to 600,000 tons or more for 2012 crop.

Contracts were reported at $450 per ton prior to the Acreage report. The downside risk is limited right now given shelled prices of 55 cents per pound. The upside is acreage is cut back and shellers and manufacturers will try to utilize the large surplus. If the 2013 production turns out much more than 2 million tons will be bearish for prices, below 2 million tons will be bullish.

Thanks to Dr. Nathan Smith for the above report.

Leave a comment